Finding New Jersey's Rental Investment Hotspots

Looking for the best rental markets in NJ in 2025?...

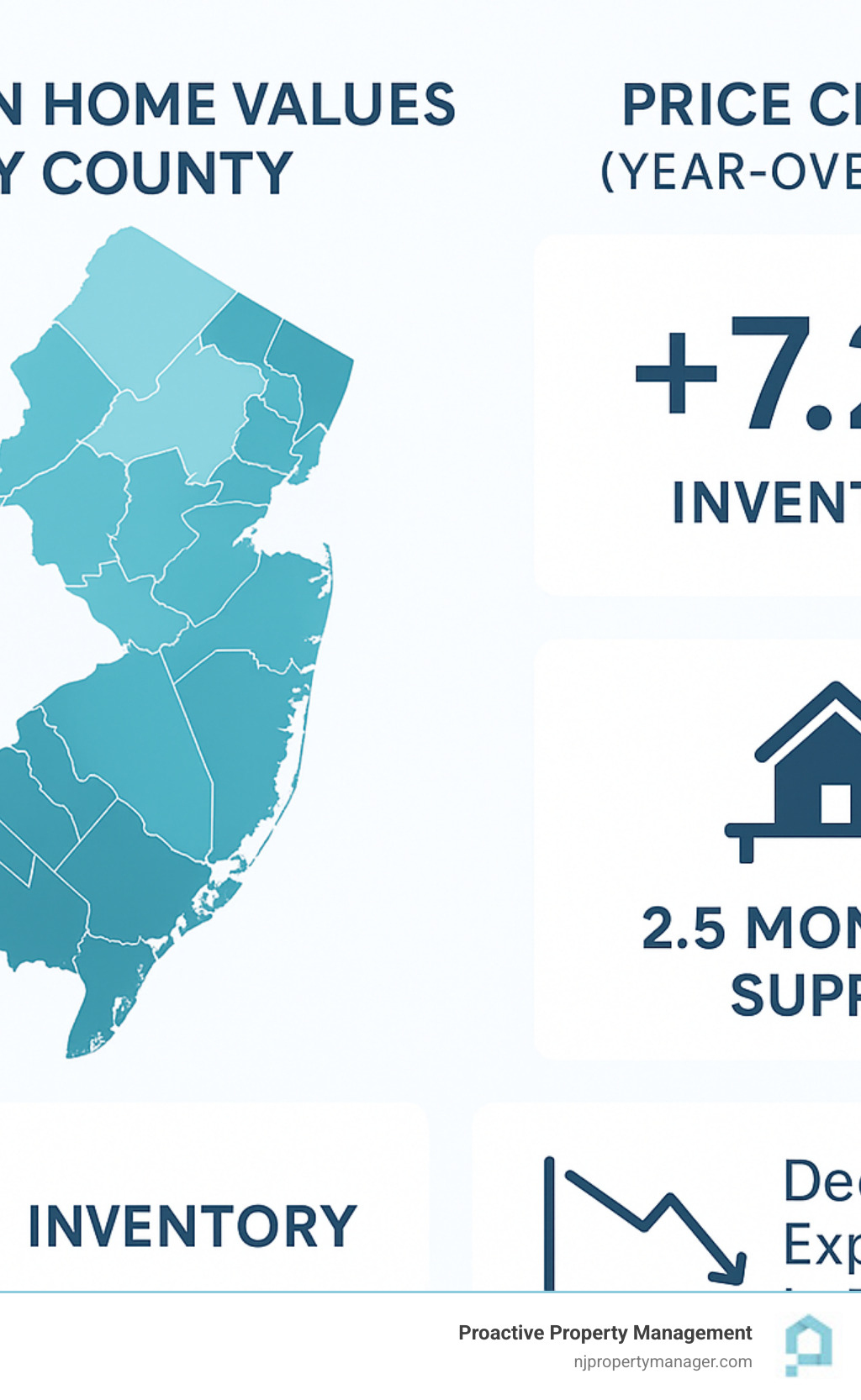

The housing market NJ is experiencing significant shifts in 2025, with home values up 7.2% year-over-year but forecasts predicting modest declines by summer. Here's what property owners and investors need to know:

Key 2025 Market Indicators: - Average home value: $542,608 (up 7.2% annually) - Time to pending: 24 days average - Inventory supply: Only 2.5 months (strong seller's market) - Closed sales: Up 12.5% in December 2024 - Affordability index: Dropped to 78 for single-family homes

New Jersey's real estate landscape continues to defy national cooling trends. While existing home sales fell to a 14-year low nationwide, homes in NJ often go under contract within days of listing. The state's unique position - with tight inventory, strong rental demand, and proximity to major employment hubs like NYC and Philadelphia - creates distinct opportunities and challenges for different market participants.

Recent data shows interesting regional variations. Shore counties like Monmouth saw median prices hit $750,000, while South Jersey markets like Cumberland County remain more accessible. The rental market stays robust with year-over-year rent increases, making NJ attractive for buy-and-hold investors despite higher entry costs.

I'm Daniel Rivera, owner of Proactive Property Management, and I've been navigating the housing market NJ trends for years as both an investor and property manager across northern New Jersey counties. My hands-on experience managing properties in Jersey City, Newark, and Hoboken gives me unique insight into how these market shifts affect real property owners and rental investors.

The housing market NJ continues to surprise analysts with its strength heading into 2025. While many predicted a significant cooldown, New Jersey's real estate market has shown remarkable staying power - though some interesting shifts are starting to emerge.

Let me walk you through what's really happening on the ground. The statewide median home value hit $542,608 according to Zillow's latest data, marking a solid 7.2% year-over-year increase. That's still healthy growth, even if it's more reasonable than the wild double-digit jumps we saw during the pandemic years.

What's particularly encouraging is the sales activity. Closed sales jumped 12.5% in December 2024 compared to the previous year, which tells us buyers are still actively participating despite mortgage rates sitting in that uncomfortable 6-7% range. The Federal Housing Finance Agency's All-Transactions House Price Index reached 834.41 in Q1 2024, up from 752.82 the year before - clear evidence of consistent quarterly momentum.

But here's where it gets interesting. Despite this recent strength, home values will decline by the summer according to Zillow's forecast models. They're predicting modest statewide decreases by June, covering 547 New Jersey ZIP codes with sufficient data. The good news? Only four towns are expected to see declines exceeding 2%.

Several key forces are shaping these dynamics. Supply constraints remain the biggest factor, with only 2.5 months of inventory supply available - that's down 13.8% from last year. For context, a balanced market typically needs 5-6 months of supply.

The "rate lock effect" continues to keep many homeowners on the sidelines. Think about it: if you refinanced during the pandemic at 2.5%, would you want to move and take on a new mortgage at 7%? This "golden handcuffs" situation artificially tightens inventory, creating more competition for the homes that do hit the market.

New Jersey's employment stability and proximity to major job centers keeps demand flowing. Even with more hybrid work arrangements, many professionals still value being within commuting distance of New York City and Philadelphia.

The price story across New Jersey isn't simple - it varies dramatically depending on where you're looking and what type of property you want. The statewide Zillow Home Value Index sits at $542,608, but that's just the starting point for understanding local markets.

Single-family homes command the biggest premiums, with median sales reaching $565,000 in January 2025. That represents a substantial 13% year-over-year increase and reflects why this segment drives much of the overall market appreciation.

County-level differences are striking. From our experience managing properties across multiple regions, the patterns are clear. North Jersey premium markets like Bergen County continue leading the pack, benefiting from NYC proximity and top-rated school districts. Monmouth County hit a median of $750,000 for single-family homes in March 2025, up 10.3% annually.

Shore markets maintain their appeal for both primary residences and vacation properties. Ocean County's median climbed to $606,000, representing 6.3% annual growth. The Jersey Shore's enduring attraction keeps demand liftd despite higher entry costs.

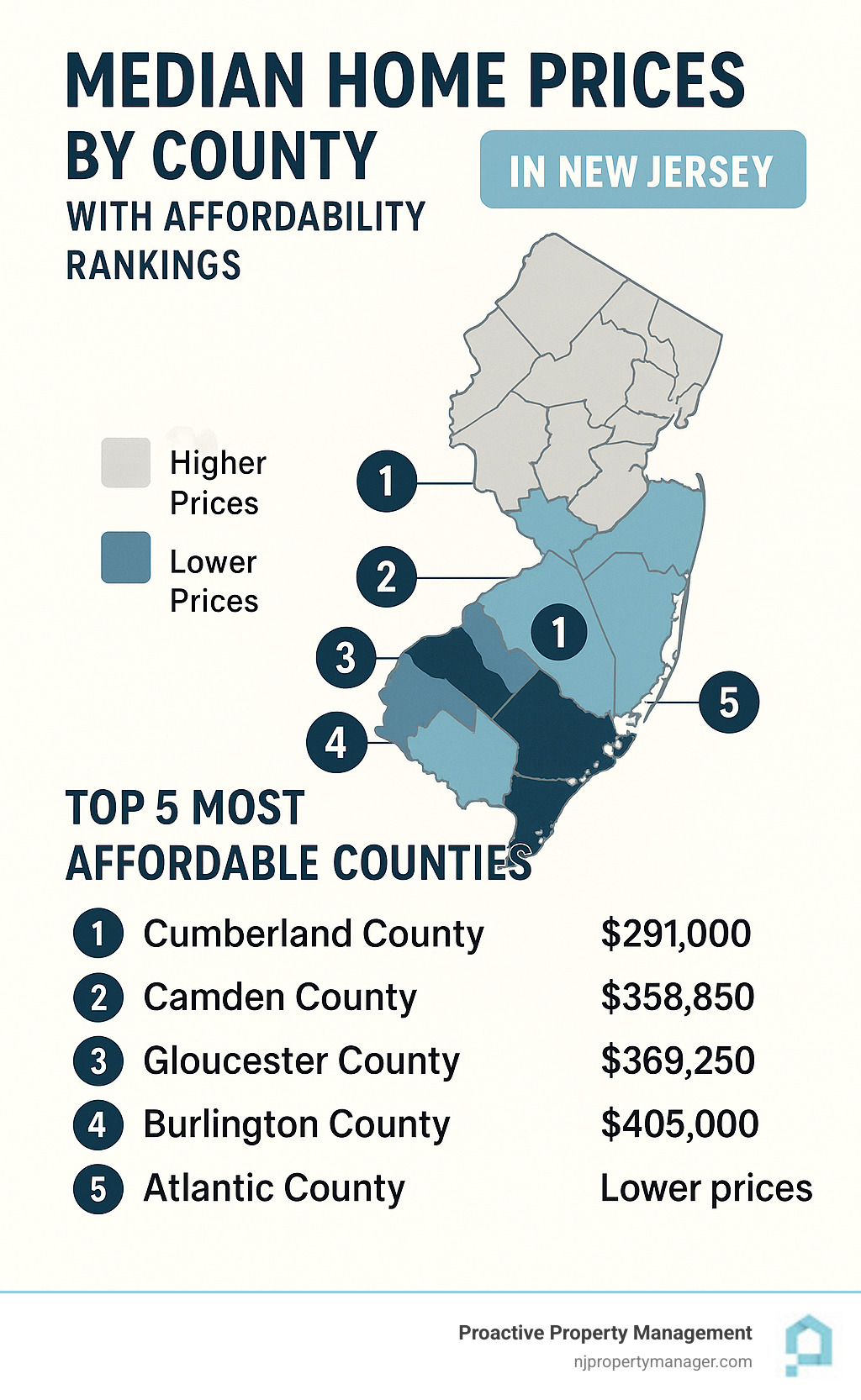

South Jersey offers more accessible options. Burlington County provides entry points around $405,000, while Camden County sits at $358,850. Cumberland County remains the most affordable at $291,000, though even these markets saw steady appreciation throughout 2024.

The townhouse and condo segment creates alternative pathways into homeownership, with median values reaching $426,250 in January 2025 - a more moderate 7.9% increase. This segment particularly appeals to first-time buyers and downsizers seeking lower maintenance lifestyles.

The inventory situation tells the most important story in today's housing market NJ. New listings surged 52.9% from December 2024 to January 2025, providing some much-needed relief after the typically slow winter months.

But don't let that jump fool you - we're still operating in an extremely tight market. The months supply of single-family homes remains at just 2.5 months, well below the 5-6 months needed for healthy market balance. This creates intense competition among buyers, with homes frequently selling above list price and multiple offer scenarios becoming routine.

The "rate lock effect" I mentioned earlier continues constraining supply in a big way. Homeowners who secured mortgages during the pandemic's ultra-low rate environment - often below 3% - are understandably reluctant to move and take on new financing at current rates near 7%. This dynamic essentially locks up existing inventory, forcing buyers to compete for the limited homes that do come available.

Sales velocity stays strong despite affordability challenges. The affordability index for single-family homes dropped 13.3% year-over-year to 78, meaning median-income households have only 78% of the income needed to qualify for a median-priced home under current mortgage rates. Yet buyers continue entering the market, often paying 101.3% of list price on average.

From our property management perspective, this inventory crunch creates real opportunities for rental property investors. Many potential buyers are choosing to rent longer while waiting for either rates to decline or more inventory to become available. This keeps rental demand liftd across our service areas, supporting both rent growth and occupancy rates.

The 24-day average time to pending reflects how quickly quality properties move when priced correctly. In our experience, well-prepared listings often receive multiple offers within the first week, especially in desirable school districts or commuter-friendly locations.

New Jersey's unique geography creates three distinct housing markets that feel almost like separate states. Each region has its own personality, price points, and opportunities that savvy buyers and investors need to understand.

North Jersey operates like an extension of the New York City metro area. Counties like Bergen, Essex, Hudson, Morris, Passaic, Sussex, Union, and Warren command premium prices because you're paying for convenience. The train ride to Manhattan, the established neighborhoods, and those highly-rated school districts all come with a price tag. Our experience with the Bergen County housing market shows how competitive this region can get - properties often sell within days of listing.

Central Jersey strikes a nice balance that appeals to families and investors alike. You get reasonable access to both NYC and Philadelphia without the sky-high prices of North Jersey. This middle ground attracts people who want more space for their money while keeping their commute manageable.

South Jersey offers the best entry points for first-time buyers and cash flow investors. The housing market NJ dynamics here favor those looking for affordability over prestige. We've seen great opportunities for investing in Newark NJ real estate and similar markets where rental demand stays strong despite lower purchase prices.

Shore markets deserve their own category entirely. These coastal communities have evolved from seasonal vacation spots to year-round destinations. Monmouth and Ocean counties now attract permanent residents who work remotely or don't mind the commute for that beach lifestyle.

The surprise winner this year? Edgewater metro area saw incredible growth, though those dramatic percentage increases often reflect smaller sample sizes rather than sustainable trends.

The housing market NJ really comes down to three main property types, each serving different needs and budgets. Understanding these segments helps you make smarter decisions whether you're buying your first home or building an investment portfolio.

Single-family homes remain the crown jewel of New Jersey real estate. These properties saw the strongest appreciation this year and continue to attract the most competitive bidding. With only 2.5 months of supply available, finding the right single-family home often means acting fast and coming in strong with your offer.

Families gravitate toward single-family properties for obvious reasons - space, privacy, and that sense of ownership that comes with your own yard. From an investment standpoint, these properties typically offer the best long-term appreciation potential, though the higher entry costs can impact cash flow initially.

Townhouses and condos provide a smart entry point for many buyers. The more moderate price appreciation compared to single-family homes doesn't mean these properties are underperforming - they're just serving a different market segment. First-time buyers love the lower maintenance requirements, while investors appreciate the typically better cash flow potential.

We've managed numerous townhouse and condo properties across our service areas, and they often make excellent rental investments. The lower purchase prices mean you can achieve positive cash flow more easily, especially in areas with strong rental demand.

Adult communities represent a specialized but stable market segment. These age-restricted developments (usually 55+) saw more modest price growth, which actually reflects the price-conscious nature of this demographic. Sales activity decreased slightly, but that's typical when buyers have more time to be selective.

For investors, adult communities can be goldmines for buy-and-hold strategies. The tenant base tends to be stable, responsible, and long-term. The trade-off comes in potentially limited liquidity when it's time to sell, since you're marketing to a smaller buyer pool.

The price leaders tell the story of New Jersey's economic geography. Monmouth County continues to command top dollar because it offers that magical combination of shore access, excellent schools, and reasonable commuting options to New York City. It's expensive, but people pay for the lifestyle.

Bergen County maintains its premium status as the gateway to Manhattan. The established wealthy communities, top-tier school districts, and extensive public transportation make it worth the premium for many buyers. We see consistent demand in our Bergen County properties because the fundamentals remain so strong.

Cape May County presents an interesting case study in vacation market evolution. The limited developable land combined with growing year-round population has pushed values well above what you might expect for a shore community. It's not just summer homes anymore - people are making these places their primary residences.

On the value side of the equation, Cumberland County offers the most accessible entry point statewide. Gloucester County provides that sweet spot of affordability with reasonable access to Philadelphia job markets. These areas appeal to first-time buyers and investors seeking better cash flow opportunities.

The projected decline in Port Norris reflects broader challenges facing rural markets without strong economic drivers. It's a reminder that location fundamentals still matter more than anything else in real estate.

South Jersey momentum appears strongest along the I-295 corridor, where smart money recognizes the value proposition. Towns like Moorestown, Mount Laurel, and Marlton offer quality schools and transportation access at prices that still make sense. For investors willing to look beyond the obvious North Jersey markets, South Jersey presents compelling opportunities with better cash flow potential and room for appreciation.

The current housing market NJ landscape presents a fascinating mix of opportunities and problems that vary dramatically depending on your role in the market. Whether you're looking to buy your first home, sell a property, or build an investment portfolio, understanding these dynamics can make the difference between success and frustration.

The affordability challenge has become the defining issue for buyers in 2025. With the affordability index sitting at 78, median-income households need about 80% more income than they currently have to qualify for a median-priced home. This creates real hardship for first-time buyers who haven't built equity through previous homeownership.

Yet sellers are experiencing quite the opposite reality. Homes are selling at 101.3% of list price on average, and many properties receive multiple offers within days of listing. The 24-day average time to pending status means sellers often have their pick of qualified buyers.

For investors, the housing market NJ presents compelling opportunities despite higher entry costs. Strong rental demand continues across the state, with year-over-year rent increases reported in most markets. The combination of limited homeownership accessibility and steady population growth creates sustained demand for quality rental properties.

One trend we've found particularly interesting is the return of former New Jersey residents. Climate events, rising insurance costs, and changing tax situations in states like Florida and the Carolinas are driving some reverse migration back to the Garden State. These returning residents often have specific housing needs and represent an unexpected source of demand.

New Jersey's position as a climate refuge also adds long-term value to real estate investments. As extreme weather becomes more common in other regions, our state's relatively stable climate and robust infrastructure become increasingly attractive to both residents and investors thinking about the next decade.

The rental market dynamics we see across our managed properties reflect these broader trends. Many potential buyers are choosing to rent longer while waiting for either rates to decline or more inventory to become available. This keeps rental demand strong and creates opportunities for property owners who understand how to position their investments.

For deeper insights into investment strategies, our guides on NJ real estate investing and the best real estate investment spots in Bergen County, NJ provide detailed analysis of current opportunities.

Succeeding as a buyer in the housing market NJ requires both strategy and realistic expectations. The days of leisurely home shopping are gone - today's buyers need to be prepared, decisive, and creative with their financing.

Rate buy-downs have become an essential tool in this environment. When mortgage rates sit near 7%, having the seller contribute to closing costs in exchange for a slightly higher purchase price can significantly reduce your monthly payments during the first few years. This strategy often makes more financial sense than waiting for rates to drop.

Condo entry points offer the most realistic path to homeownership for many buyers. With townhouse and condo properties offering better affordability ratios than single-family homes, these properties can serve as stepping stones to larger homes later. The key is viewing them as wealth-building tools rather than compromise purchases.

New Jersey's down payment assistance programs provide crucial support for first-time buyers. These state and local programs can help with both down payments and closing costs, particularly in designated areas. The application process takes time, so start early and work with a lender familiar with these programs.

Speed matters more than ever when homes go pending in just 24 days on average. Getting pre-approved with multiple lenders not only shows sellers you're serious but also gives you options when it's time to move quickly. Have all your financial documents ready and be prepared to make decisions within hours rather than days.

Geographic flexibility can dramatically improve your buying power. South Jersey markets offer significantly better value propositions, and with hybrid work arrangements becoming permanent for many employers, a slightly longer commute might be worth the savings and extra space.

Sellers in today's housing market NJ enjoy tremendous advantages, but maximizing your return still requires thoughtful strategy and timing.

Strategic pricing can actually increase your final sale price. With homes selling at over 101% of list price on average, pricing slightly below market value often generates multiple offers that drive the final price above asking. This works particularly well in high-demand areas where buyer competition is fierce.

Pre-inspection strategies build buyer confidence and prevent deal-killing surprises. By conducting your own inspection and addressing major issues upfront, you eliminate one of the biggest sources of transaction delays and renegotiation. Buyers appreciate transparency and often pay premiums for move-in ready properties.

Timing your listing around low-supply periods maximizes your competitive advantage. The 52.9% jump in listings from December to January shows how dramatic seasonal swings can be. Listing during traditionally slow months means less competition from other sellers.

High-impact improvements matter more in a premium market. Fresh paint, updated fixtures, and improved curb appeal create strong first impressions. Since buyers are paying top dollar, they expect properties that show well and feel move-in ready.

Professional marketing has become non-negotiable. High-quality photography and virtual tours are essential since most buyers start their search online. First impressions determine whether they'll schedule a showing, and in a fast-moving market, you can't afford to lose potential buyers to poor presentation.

Real estate investment in the housing market NJ requires careful analysis of both acquisition costs and rental market fundamentals. The strong seller's market creates challenges for acquiring properties, but rental demand remains robust across most markets.

Rent growth opportunities continue to support investment returns despite higher acquisition costs. Year-over-year rent increases across the state create positive cash flow trends for buy-and-hold investors. Focus on areas with strong employment growth and limited new rental construction for the best long-term prospects.

Short-term rental markets offer opportunities in shore areas, but require careful research of local regulations. Many municipalities have implemented restrictions on platforms like Airbnb, so understanding the rules before purchasing is essential. When allowed, these properties can generate strong seasonal returns.

Cap rate targets need adjustment for New Jersey's higher cost environment. With increased acquisition costs and property tax burdens, targeting properties that can achieve solid returns after all expenses often means focusing on multi-family properties or emerging neighborhoods with growth potential.

1031 exchange strategies become particularly valuable in strong seller's markets. Using these exchanges to move equity from appreciated properties into higher cash flow opportunities allows investors to take advantage of current market conditions while building long-term wealth.

For detailed frameworks on evaluating investment properties, our guide on real estate market analysis provides comprehensive tools for making informed decisions.

Property management considerations become even more critical in New Jersey's complex regulatory environment. Our state's tenant-friendly laws and detailed regulations make professional management valuable for protecting your investment. From rigorous tenant screening to proactive maintenance coordination and transparent financial reporting, the right management approach maximizes returns while minimizing owner headaches and legal risks.

The housing market NJ outlook for 2025 tells a story of moderation rather than dramatic shifts. While Zillow's forecast suggests statewide home values will dip by summer, we're talking about gentle corrections - typically less than 2% in most areas.

Here's what makes this prediction interesting: out of 547 New Jersey ZIP codes with sufficient data, only four towns are expected to see declines exceeding 2%. Port Norris faces the steepest projected drop at 2.5%, but that's still relatively modest compared to the boom-and-bust cycles we've seen in other states.

The FHFA All-Transactions House Price Index paints a more optimistic picture, climbing from 752.82 in Q1 2023 to 834.41 in Q1 2024. This steady upward trend reflects the underlying strength of New Jersey's housing fundamentals.

What's supporting continued stability? The math is pretty straightforward. We're sitting on just 2.5 months of inventory when a balanced market needs 5-6 months. Strong employment markets in both the NYC and Philadelphia metro areas keep demand steady. New construction hasn't kept pace with population growth, and we're even seeing some folks move back to New Jersey from states they fled to during the pandemic.

The most realistic scenario involves price growth slowing to a more sustainable 2-5% annually rather than the double-digit jumps of recent years. Think of it as the market catching its breath rather than falling off a cliff.

First-time buyers often ask me where they can actually afford to buy in New Jersey without breaking the bank. The good news is that South Jersey offers several counties where homeownership remains within reach.

Cumberland County leads the affordability charge with the lowest median prices statewide. Camden County and Gloucester County follow close behind, offering significantly better value than their North Jersey counterparts. Burlington County provides another accessible option, while Atlantic County varies depending on how close you get to the shore.

What makes these areas particularly attractive goes beyond just lower purchase prices. Property taxes tend to be more reasonable than North Jersey's eye-watering rates. You'll find reasonable commuting access to Philadelphia's job market. The growing healthcare, education, and logistics sectors are creating new employment opportunities right in these counties.

From our property management experience, these markets also tend to have more inventory available, which means fewer bidding wars and more negotiating power for buyers. Cumberland County stands out as the most budget-friendly option, though you'll want to factor in job opportunities and commuting needs when making your decision.

Mortgage rates near 7% have created what I call the "great housing freeze" - but not in the way you might expect. The housing market NJ is experiencing something fascinating: demand remains strong even as affordability plummets.

The "rate lock effect" explains much of what we're seeing. Homeowners who refinanced during the pandemic at rates below 3% are essentially trapped in their current homes - not by financial distress, but by the math of taking on new financing at more than double their current rate.

Here's how the numbers shake out: The affordability index dropped to 78, meaning median-income households need about 25% more income to qualify for the same home compared to last year. Many potential buyers are sitting on the sidelines, hoping rates will drop. This has boosted rental demand significantly across our managed properties.

Yet somehow, closed sales still jumped 12.5% in December 2024. Life doesn't stop for mortgage rates. People still get new jobs, have babies, get divorced, or need to downsize. These motivated buyers are finding ways to make deals work.

Buyers are getting creative with rate buy-down programs, longer loan terms, and adjustable-rate mortgages making a comeback. We're seeing more interest in the townhouse and condo markets where lower purchase prices help offset higher borrowing costs.

The refinance history creates a unique dynamic where potential move-up buyers - who normally drive a lot of market activity - are staying put. This reduces both supply and some demand pressure, creating an odd equilibrium that keeps the market moving despite challenging conditions.

The housing market NJ in 2025 tells a story of resilience and adaptation. While Zillow's forecasts suggest modest price declines by summer, the fundamentals painting the bigger picture - that persistent inventory shortage, robust employment centers, and constrained new construction - continue supporting market strength in ways that matter most to property owners and investors.

What we're seeing isn't a market crash, but rather a natural evolution toward more sustainable growth patterns. After years of double-digit appreciation, the shift to 2-5% annual growth represents a healthier long-term trajectory that benefits everyone involved.

Buyers have reason for cautious optimism. Yes, affordability remains challenging with that 78 affordability index, but opportunities exist for those willing to think strategically. The townhouse and condo markets offer genuine entry points, while South Jersey's value propositions become increasingly attractive as remote work options expand. Rate buy-downs and first-time buyer programs provide tools that many don't even know exist.

Sellers continue enjoying favorable winds. When homes consistently sell at 101% of list price and inventory stays tight, the market clearly favors those ready to move. The key lies in understanding that even seller's markets reward strategic thinking - proper pricing, presentation, and timing still determine whether you capture maximum value.

Investors face a more nuanced landscape where success depends heavily on location selection and management excellence. Higher entry costs demand more sophisticated analysis, but rental demand remains robust across our service areas. The return migration trends and climate considerations we're observing suggest sustained long-term demand that supports investment strategies.

At Proactive Property Management, we've guided property owners through multiple market cycles across Jersey City, Newark, Hoboken, and throughout Bergen, Essex, Hudson, Morris, Passaic, Sussex, Union, and Warren counties. Our comprehensive approach - from strategic marketing and rigorous tenant screening to proactive maintenance coordination and transparent financial reporting - helps investors maximize returns regardless of whether markets are rising, falling, or finding their balance.

The 2025 outlook suggests we're entering a more balanced phase where knowledge and professional guidance matter more than ever. The housing market NJ rewards those who understand local nuances, maintain strategic flexibility, and work with experienced partners who've steerd these waters before.

Success in New Jersey's real estate environment has always required understanding the unique dynamics of our diverse regions, complex regulations, and competitive landscape. That hasn't changed - if anything, it's become more important as markets moderate and margins for error shrink.

For more information about our property management services and how we can help you steer the housing market NJ, visit our NJ service areas page. Whether you're buying your first home, selling an investment property, or building a rental portfolio, understanding these market dynamics positions you for success in New Jersey's evolving real estate landscape.

The opportunities are there for those prepared to recognize and act on them. Stay informed, stay flexible, and remember that even in changing markets, quality properties in good locations with professional management continue generating solid returns for patient investors.

Looking for the best rental markets in NJ in 2025?...

If you're searching...

Subscribe to receive real estate investment news and industry insights.

Comments